- Home Accounting Software For Mac Free Trial

- What Is The Best Home Accounting Software For Mac

- Home Accounting Software For Mac Free

- Home Accounting Software For Mac Free Full

- Home Accounting Software Microsoft

Best Free Accounting Software For Mac; Free Home Accounting Software For Mac; No internet connection required. Fully-featured and free forever. Work smarter with cloud-based accounting software for Mac. Now you can get your finances in order with Sage Business Cloud Accounting; our secure, cloud-based range of accounting solutions is ideal for. GnuCash is personal and small-business financial-accounting software, freely licensed under the GNU GPL and available for GNU/Linux, BSD, Solaris, Mac OS X and Microsoft Windows. Designed to be easy to use, yet powerful and flexible, GnuCash allows you to track bank accounts, stocks, income and expenses. As quick and intuitive to use as a. Then try GnuCash accounting software perfectly suited for both personal and business finance. GnuCash is an open source home business accounting software, available on several platforms. The software works on Windows, Mac, Linux, Android, FreeBSD and more. You can use the accounting software to handle transactions in different currencies. Accounting Software for Mac Free Download. Get started using best-in-class accounting software for student Mac with a free 30-day trial. FreshBooks lets you test out our easy-to-use features for a full 30 days before committing — no strings attached and no fine print. You don’t even need a credit card number to get started.

Home Accounting Software For Mac Free Trial

In this article, you will learn:

Most of us do not have control over our financial life. This is because we fail to organize our home expenses, payments, and prepare budgets to have full command over our personal financial goals.

Lack of organization of personal financial information at one place makes it challenging for us to get a snapshot of our spendings, personal savings, managing day-today aspects of our life, and accomplishing long term financial goals.

Whether it’s keeping a track of our monthly grocery budget or saving funds for your child’s education, all of this is quite challenging to achieve without having a proper home accounting software.

A home accounting software can help you get rid of all of these challenges and allow you to manage your finances quite effectively. So, in order to make your life simple, run your home or your business out of your home anytime, anywhere with reliable accounting software for home use.

In this article, we will learn what is a home accounting software, the features of home accounting software, and what are the benefits of using such software.

What is Home Accounting Software?

Accounting software for home use is the one that enables you to manage your personal finances effectively by tracking your income and expenses and budgeting for future occasions.

A home accounting software also keeps a track of your bank accounts and identifies the areas where your money is spent. It uses a simple double-entry bookkeeping system that allows you to record any payment or receipt with regards to any income, expenditure, asset, or liability.

Also, you can have access to your receipts, checks, as well as online banking as online accounting software for home use gets connected to your phone, tablet, and the computer instantly.

Thus, with home accounting software, you can:

- connect your bank accounts

- get a snapshot of your bank account balances

- create income and expense categories to know what comes in and goes out

- reconcile your accounting statements with bank statements

- create a chart of accounts for assets, liabilities, and investments to know your net worth

- prepare a budget in order to track future spending and compare your actual spendings with the budgeted spendings

Features of Home Accounting Software

Simple accounting software for home use allows you to run your home just the way you run your business. It also helps you to run your business out of your home without investing in a home accountant to manage your accounts.

Home-based accounting software has the following features:

- Tracks Income and Expenses

Accounting software for home use integrates all your bank accounts thus allowing you to keep a track of where your money is going. Once you integrate your credit cards, bank accounts, Paypal, and more, you can securely import your transactions which then get automatically sorted into various income and expense categories. You can even snap photos of your receipts and the home accounting software will automatically match them with your existing expenses.

- Capture and Organize Receipts

Gone are the days when you had to deal with a stack of home expense receipts against utility, grocery, and other day-to-day expenditures. Remember the time when you had to go through the hassle of keeping a record of physical receipts and vouchers only to record them in your books later?

Well, with a simple home accounting software, there is no need for you to maintain a record of physical receipts and vouchers as you can snap the photos and add your receipts on the go.

Besides this, you can even upload your receipts and match them to existing expenses or create new expense categories. Furthermore, you can classify your receipts into various tax categories so that you do not have to undergo stress while filing tax returns.

- Create Invoices and Accept Payments

If you are using a home accounting software to run a business out of your home, you can create professional-looking invoices within minutes and get paid faster. Furthermore, you can also accept bank and credit card transfers in the invoice itself. Also, you can track the status of your invoice, send payment reminders, and match your payments to invoices automatically with accounting software for home use. Besides this, you can even customize your invoices with your company logo and can send them via any device.

- Get Ready for Tax

A home accounting software helps you to avoid the stress that you have to undergo during the tax period. This is because you can easily organize your income and expenses into various categories and subcategories and hence estimate how much taxes are due each quarter. You can even set automatic reminders of quarterly tax due dates in a home accounting software to avoid any kind of penalties.

- Pay Your Employees

A home accounting software helps you to track employee time, billable hours by your clients and incorporates such information automatically into your invoices. You can either add the employee hours yourself or give access to employees so that they can complete their timesheets on their own. Such a process helps you to pay your employees easily.

- Team Collaboration

Accounting software for home use allows you to give access to your sensitive financial data to some of the important members of the team. This means that you can give permissions for sales transactions and expense reports, deposits, and much more to specific individuals within your team. Besides this, you can assign work to specific users, thus increasing the productivity of your team.

- Prepare Budgets

In order to run your house properly, it is very important to prepare a budget that includes an estimated amount of various home expenses like groceries, utilities, home rentals, taxes, etc.

Furthermore, if you are running a business from home, you can prepare budgets as per your business need with the help of home accounting software. This will help you in converting estimates into invoices quite easily.

- Create Reports

With home accounting software, those of you who are working from home or self-employed can create basic financial reports like Profit and Loss, expenses, and balances. These customized reports give you important insights with regard to the various aspects of your business. Thus, such a feature helps you to keep a track of cash flow and reports the same on the dashboard of the accounting software for home use. With such valuable insights, you can certainly make better business decisions.

All About Quickbooks Home Accounting Software

Whether it’s running your home or running a business out of your home, Quickbooks gives you smarter tools to organize all your expenses, payments, and other transactions, all in one place.

These tools help you manage your home affairs right from online banking access to managing receipts and checks. Thus, Quickbooks home accounting software helps you run your home from anywhere, via any device so that you can get more done.

Since Quickbooks keeps a track of everything all in one place, it helps you to budget your day to day spending. Not only that, but you can also pay people in time, update your finances automatically, balance your checkbooks and budgets, and get prepared for tax period via Quickbooks home accounting software.

Since Quickbooks home accounting software is cloud-based, your financial data gets safely hosted on the cloud so that you can access it anytime, anywhere, and across any device.

So, with Quickbooks accounting software for home use, you need not get worried about staying on budget, paying your housekeepers, sending invoices, managing receipts, and tracking sales and expenses.

Therefore, Quickbooks offers the following feature to make your ride easy as far as managing your home finances are concerned:

- Track Expenses

Track your expenses by connecting your Quickbooks accountant to your bank accounts, credit cards, and much more. Create custom rules to categorize your expenses and generate reports to know your spendings.

- CaptureReceipts

Snap photos of receipts with the Quickbooks mobile app and match your receipt information to an existing transaction.

- Be Tax Ready

Since Quickbooks automatically categorizes expenses and organizes them in one place, you can easily track expenses all year round. Therefore, you do not have to worry about overlooking tax deductions and undergoing stress during tax filing.

- Generate Professional Invoices

Do not worry about generating invoices when running a business from your home as Quickbooks home accounting software helps you create professional-looking invoices tailored for your brand within no time. Besides, it helps you set up recurring invoices for regular customers a well as automatically adds billable hours to the invoices both for clients and employees. Apart from this, Quickbooks automatically matches your payments with the invoices in order to balance your books of accounts.

- Accepting Payments

Quickbooks payments allow you to accept credit cards, debit cards, and bank transfers so that you can accept all types of payments quickly and easily. It also helps you to keep track of your bank balance and know when payments hit your account so that you can make payments on the go.

- Manage Your Bills

With Quickbooks accounting software, you can organize and manage your bills all in one place. Since the bills or receipts are saved in the cloud, there is no chance that you ever overlook any receipt or invoice. Furthermore, you can schedule your bills in advance so that its easier for you to manage your expenses. Also, you can track the due dates of your bills in order to make payments in time directly via Quickbooks.

- Pay Your Bills

There are various ways with the help of which you can settle your bills via Quickbooks. Also, you can pay multiple vendors all at once and also a select method of payment for each of the vendors. Since your business bank account is connected with Quickbooks, the bills that you pay via check or direct deposit get automatically recorded in Quickbooks. In addition to this, you can even make partial payments against the bills by simply filling in the amount that you want to pay. Thus, Quickbooks will automatically keep a track of the outstanding amount to be paid on a specific bill.

- Track Mileage

In order to add to your potential tax deductions, Quickbooks home accounting software gives you the functionality of tracking mileage automatically via GPS so that you can claim a tax deduction for mileage. Also, you can easily categorize individual trips as either business or personal and get a breakdown of miles in mileage reports that can be shared easily for availing deductions.

- Easy Collaboration

Quickbooks home accounting software allows you as a small business owner to give access to Quickbooks accounts to various employees and partners like sales reps, office managers, etc. Such custom access to Quickbooks would help you to share limited insights with business partners and investors. You can even collaborate with accountants by sending them an invitation to log into Quickbooks account separately.

- Track Time

As a small business owner running your business from home, you can track the time spent by your employees on specific jobs by giving them access to your Quickbooks account so that employees can fill in their timesheets and mark billable hours. Such seamless integration of employee time to Quickbooks would help in preparing accurate timesheets and would enhance payroll.

What is the Purpose of Accounting Software?

Cloud-based accounting software helps you maintain your books of accounts online, anytime, anywhere, and through any device. Since the cloud-based accounting software connects to your bank account, it helps you keep a track of what comes in and goes out of business.

Furthermore, it automates your day-to-day tasks such as managing receipts, creating and sending invoices, data entry, and bank reconciliation.

Besides this, a cloud-based accounting software gives you a snapshot of where your business stands as all the transactions are updated on a regular basis. It also allows you to collaborate with your employees, partners, accountants, and other stakeholders by giving partial or complete access, as per the need. Most importantly, the chances of committing errors are reduced drastically as the information gets updated into your Quickbooks account automatically on a regular basis.

Thus, the purpose of accounting software is to:

- automate day to day tasks like creating and sending invoices, data entry, bank reconciliation, receipt management, etc

- provide world-class data security as the financial data gets saved in the cloud

- give access to multiple users for easy collaboration

- generate and access financial reports at the click of a button

- give an overview of the financial position of your business as and when income and expenses get updated

- improve the accuracy of data by categorizing income and expenses

- saves time and cost as you bank accounts are connected with the online accounting software, which fetches your accounting transactions automatically

- lend mobility as you and run your home and manage the business on the go

Is the Prerequisite Accounting Knowledge Required to Operate Accounting Software?

There are a number of aspects with regards to your business finance that do not necessarily require accounting knowledge or the experience of an accountant. If you want to manage your home finances or run a business out of your home, then an online home accounting software would help you to carry out the day to day tasks quite easily and effectively.

By spending a small amount every month, a cloud-based home accounting software provides you with smarter tools to manage various simple tasks like:

- recording and tracking expenses

- creating and sending invoices

- generating basic financial statements or reports

- reconciling transactions with bank statements

- managing and organizing bills

- tracking time

- managing your contacts

Thus, to perform such day-to-day tasks, an online home accounting software is quite user-friendly and intuitive to help you take control of your finances, in case you do not have any financial or accounting knowledge.

However, there are some tasks that require the expertise of an accountant, especially when you are running a small business.

For instance, deciding your business structure and preparing a business plan is quite challenging without taking the advice of an accounting professional. Besides this, submitting tax returns to statutory authorities requires precision as well as expertise in providing accurate data.

What Factors Should be Considered Before Choosing Accounting Software?

Good accounting software for home use must offer functionalities that help in automating the entire accounting process, providing data security, generating accurate financial reports, and offering customer support when needed. Therefore, before investing in a home accounting software, the following are the factors that you need to consider:

- Mobility

- price

- seamless collaboration

- ease of use

- import or export of data

- high-end data security

- round the clock customer support

- regular software updates

- automation

What are the Benefits of Accounting Software?

More and more businesses are now using cloud accounting software to manage their finances. This is because cloud technology has dynamically transformed the way businesses manage finances in day-to-day lives.

The financial information is saved in the cloud and is encrypted, thus, only people having access to their accounting software can view this information.

Furthermore, a cloud accounting software offers a host of tools that help in automating the accounting process as well as undertaking day-to-day tasks like generating invoices, managing bills, preparing budgets, and much more.

Hence, if you haven’t upgraded to a cloud accounting software, then the following benefits of a cloud accounting software would certainly help you in giving a direction.

- Brings Automation

A cloud accounting software integrates your bank accounts and updates income or expenses automatically as and when a transaction takes place. It sorts this income or expense into various categories and creates new categories for the expenses that have not been recorded previously.

Besides, you can even generate invoices and send them directly to your customers to get paid faster. Furthermore, reconciling your income or expense statement with a bank statement is quite easy as you simply need to match book entries with bank transactions.

- Data Security

Cloud Accounting Software provides world-class data security. This is because unlike the traditional accounting system, all your financial data gets stored in the cloud and is backed up regularly. Therefore, you do not have to worry about your data being hacked.

- Mobility

Cloud-based accounting software allows you to work anytime, anywhere, and through any device, as you simply need to log into your account via the internet and get started. This means there is no need for you to get bound to your desk or maintain spreadsheets to organize your data.

With the help of an app or via a web browser, you simply need to connect to your account and access financial information on-the-go.

- Cost-Effective

Since online accounting is carried out from the cloud, you do not have to worry about investing in IT infrastructure. The traditional accounting systems demanded huge investment in IT infrastructure as well as its maintenance. But via cloud accounting, you can access your financial information in the office, at home or during a customer meeting.

And for this, you simply need to pay a small amount of either monthly fee or yearly. This is in contrast to the traditional accounting software where no doubt you have to invest one time, but relatively, the cost is huge.

- Easy Collaboration

Cloud-based accounting software allows you to easily collaborate with fellow accountants, employees, and other stakeholders. This is achieved by giving limited access to each of them depending upon the task they undertake.

For instance, the employees can access timesheets in order to regularly update their logged in hours. Similarly, your accountant can have access to accounting information so that the data is recorded with accuracy and financial reports like income statement, balance sheet, etc are prepared regularly.

Thus, with a cloud accounting software, your colleagues, management team as well as your advisers all have access to the same numbers and reports instantly from any geographical location.

- Constant Software Updates

Cloud accounting software is constantly updated by the in-house developers for change in accounting rules or taxation laws. So you do not have to worry about your financial statements, tax reports, invoices, or other business forms or documents not incorporating the latest changes.

- Third-Party Integrations

Get more done with a cloud accounting software as it offers third-party integrations to provide various other functionalities like payroll, inventory management, etc. Apart from helping you to carry out day-to-day tasks such as generating invoices, managing bills, and completing books of accounts, these programs help you to carry out various other aspects of your business such as managing inventory, payroll, CRM, etc.

Cloud-Based Home Accounting Software

Cloud technology has revolutionized our day-to-day life both professionally as well as personally. Be it uploading pictures on social media, paying utility and other bills via online banking, making fund transfers, or using smartphones to send and receive emails on-the-go, cloud technology has certainly enhanced the way we work and live.

When it comes to business, various cloud-based tools have been developed to launch businesses, organize teams, and serve customers through various devices such as smartphones, laptops, or tablets.

Project management, file storage, video conferencing, online accounting, and social channels are some of the areas where cloud technology has dynamically changed the way we work.

When it comes to online home accounting, Cloud-Based Home accounting software is a tool that helps you run your home as well as your business out of your home in the most effective way. The cloud technology automates the entire process of running your home, managing your personal finances, and running your business out of your home.

Be it managing bills, tracking expenses, generating invoices, scanning receipts, accepting payments, or collaborating with team members, a cloud-based home accounting software makes all of this possible in one place.

Unlike your traditional home accounting system, where you had to manually update the data in spreadsheets, collect and organize receipts, maintain a calendar to track payment due dates, a cloud-based home accounting software surpasses all these challenges and helps you to work as well as manage your home in the most effective way.

With a cloud-based home accounting software, you can:

- Organize and track your expenses

- Pay bills on time

- Connect your bank accounts and categorize expenses as and when the transactions take place

- Prepare budgets and set goals so that you avoid the risk of overspending

- Reconcile your books with bank statements

- Prepare for tax period as income and expense reports get updated automatically

- Accept payments

- Snap a photo of receipts and organize them all in one place

- Collaborate with accountants, managers, and employees to carry out various tasks by assigning roles and giving limited access

When is the Best Time to Switch to Cloud Accounting Software?

As a small business owner, you have to perform a host of activities including bookkeeping and accounting all by yourself due to lack of resources. If you are spending a good part of your time on Bookkeeping and Accounting, you would have to compromise on your core business activities including managing productivity, generating leads, building clients, etc.

So, if your business is facing the following challenges with regards to bookkeeping, then its time that you switch to a cloud accounting software.

- There is less or no automation as you are still manually preparing invoices and entering data, using a physical copy of expense receipts, and spending a good time reconciling books.

- You are desk-bound and cannot manage your books of accounts on-the-go.

- You cannot connect your bank accounts with your accounting software.

- You are manually preparing invoices and processing payroll.

- Spending too much time on secondary tasks in place of core business activities

FAQ’s

What is the Best Home Accounting Software?

What is the Best and Easiest Software for Home & Business Accounting for Dummies?

What was the Name of Intuit’s Accounting Software for Home Use?

What Accounting Software Should I Use for Home?

What is the Best Installed Combination of Home and Business Accounting Software?

What Accounting Software Do I Need for my Home?

What is the best Home Accounting or Budget Software?

What Home Accounting Software Syncs With a Phone?

If you’re in need of accounting software for your business, it’s safe to say that you’ll be using that accounting software to examine every dime coming in and out of your banking accounts.

At some point, you’ll probably ask yourself “How much am I paying each month for this accounting software, and can I eliminate that expense?”

Yes, you can get free accounting software, and in this article we’ll look at four popular and totally free options (find out how we chose the featured products here), along with a few reasons that you might be better off paying for your accounting software even when there are free options available.

Here’s what we’ll cover:

Free accounting software:

Wave

ZipBooks

Open source accounting software:

Akaunting

GnuCash

Free accounting software

While it’s not too difficult to find free versions of some business software, truly free accounting software (not just a free trial) is something of a rarity, with most popular accounting vendors charging a monthly fee for even their most basic version. These two accounting solutions, while not as advanced as their paid counterparts, are built on a foundation of features capable of meeting the needs of most small or midsize businesses.

Wave

4.4/5.0

1,037 reviews

The main dashboard in Wave Accounting (Source)

Designed with the small-business owner in mind, Wave—which was acquired by H&R Block for around $400 million in July of 2019—prides itself on its simplicity and ease of use. Its intuitive user interface keeps the most important financial data front and center, accessible immediately after signup via any device with a web browser.

The idea here is that keeping things simple relieves much of the stress associated with accounting software. But don’t be deceived by this bare-bones approach; for a free piece of software, Wave is rich in features. This includes informative user dashboards, unlimited income and expense tracking, and customizable invoicing and sales tax processes.

Other features include:

- Fast setup

- Bulk transaction updates

- Exchange rate conversions

- PayPal, Shoeboxed, and Etsy integrations

- Unlimited bank and credit card accounts

- Bill and invoice reminders

While the accounting app really is free, accepting payments (2.9% + 30 cents per credit transaction, or 1% per bank transaction) and running payroll ($20 per month plus $4 per employee) are paid, optional features.

Wave also appears on our Accounting FrontRunners list for 2021.

Not sure if Wave’s free accounting app is right for you? Check out this video walkthrough of how to set up recurring invoices:

ZipBooks

4.5/5.0

93 reviews

The main dashboard in ZipBooks (Source)

Like some other free accounting systems, ZipBooks offers a complimentary starter tier to its more robust paid options. The free version does offer notable useful features for small businesses.

For no cost, users can send unlimited invoices, process digital payments, and manage as many vendors and customers as they need. This cloud-based solution also boasts integration with third-party applications such as Square, PayPal, Slack, and Gusto, giving organizations the freedom and flexibility to do business on their terms.

Other features include:

- Custom invoices, quotes, and estimates

- Ability to toggle between cash- and accrual-based reporting

- Vendor and customer detail tracking

- VAT, taxes, and invoice discounts

- 1099 payment and expense recording

- Balance sheet and profit and loss reporting

Learn how to get started using ZipBooks with this tutorial:

Open source accounting software

If you need an accounting system that you can modify to meet your business’ unique needs, open source software is a great option to consider. Users can download the source code—usually for little or no cost—and mold it into their ideal accounting system.

Open source systems require a certain degree of development expertise. But if you have a dedicated IT department, employ a coding expert, or are willing to hire a third-party consultant, open source software offers a viable alternative to the more monolithic—and pricey—solutions on the market.

Akaunting

(No reviews yet)

The Accounts overview in Akaunting open source accounting software (Source)

The curiously named Akaunting had its first stable release in 2018 and has been growing steadily ever since, with 180,000 downloads, 80,000 cloud users, and 10,000 project contributors, according to the Akaunting website. It is available in almost 50 different languages.

Akaunting aims to remove the stigma of open source software being difficult to use, claiming to get users up and running and fully functional in less than five minutes. Users can download the main accounting core, which includes all the standard accounting features small businesses will need, and add optional features as app downloads. Some of these optional apps include contract management, documents management, white label customization, and some integrations are paid.

If you run into trouble, free support comes through extensive online documentation, and community forums and chat rooms. The project is also monetized through a paid, dedicated support service, starting at $99/month if you really need help and don’t mind spending to get it.

Core features include:

What Is The Best Home Accounting Software For Mac

- Modern, intuitive, mobile-ready interface

- Free updates for life

- Advanced reporting

- Customer and vendor management

- Recurring billing and invoicing

- Categorization and bulk actions

Want to see Akaunting in action? Check out this video:

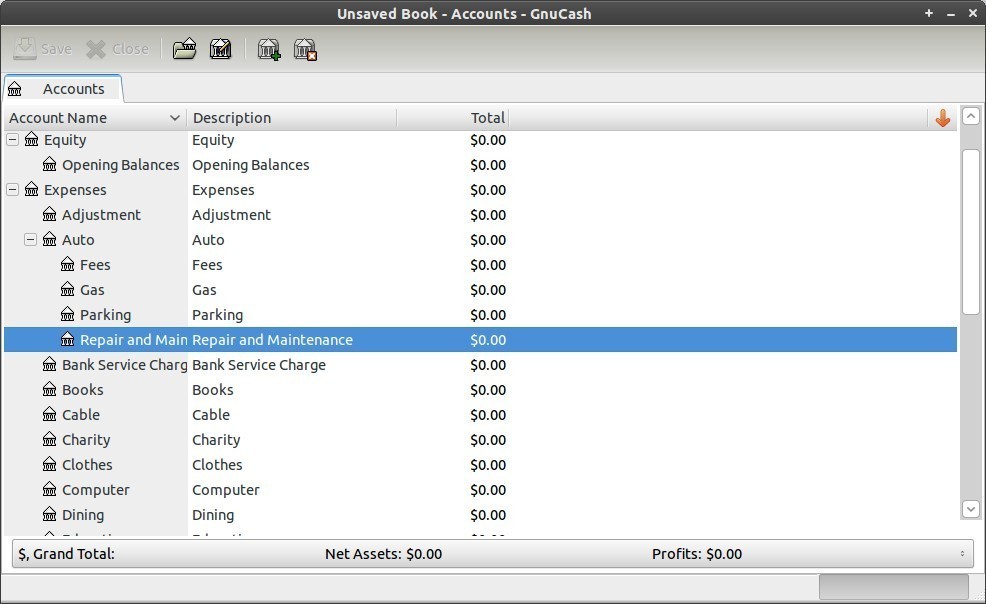

GnuCash

4.6/5.0

40 reviews

Checkbook-style register in GnuCash (Source)

This on-premise accounting solution offers a robust set of features—recurring transactions, bank reconciliation, and financial reporting among them. What’s more, it’s as affordable as it gets (i.e., free) and endlessly customizable.

The GnuCash register is like a digital checkbook of sorts, with the ability to split transactions, display multiple accounts in a single window, and tailor the appearance to your liking. But the software’s signature quality is its “double entry” feature, which mandates that all transactions must debit and credit accounts in equal measure—keeping your books balanced at all times.

Other features include:

- Track individual stocks and portfolios

- Regularly updated stock and mutual fund quotes

- Check printing

- Payroll management

- Auto-fill frequent transactions

- Income and expense categorization

Check out the video below on GnuCash for an overview of how this free accounting software works:

Home Accounting Software For Mac Free

Why you must consider paid solutions, too

While the systems outlined above might work for some organizations, they won’t work for all. In many cases—even yours, potentially—investing in a reputable paid solution will pay dividends in the long run.

So now that we’ve explored some free and open source options, you may also want to look at some top-rated paid systems, too, so you have the full picture. Check out our accounting software directory, where you can learn about common features, the products that are most recommended by our advisors, and the top rated products based on real user reviews.

The Software Advice accounting software Buyers Guide (Source)

Home Accounting Software For Mac Free Full

How we chose featured products

Home Accounting Software Microsoft

To identify the systems featured here, we Googled the terms “free accounting software” and “open source accounting software” during the month of April 2021 in an incognito window with the location set to the U.S. Provided they met the following criteria, the top solutions on the first page of search results are presented/included above in alphabetical order:

- Offer a free, standalone version of the software (not a trial version of the software where you must purchase a product after a limited amount of time).

- Meet our accounting software definition: Accounting software enables accounting professionals in any type of organization to manage accounts and perform various accounting and financial operations such as record keeping, financial reporting, billing, and invoicing.